External resources

Progress on the Sustainable Development Goals: The gender snapshot 2023

UN Women/UN DESA – September 2023

This publication is the latest installment in the annual series jointly produced by UN Women and UN DESA. The report provides a comprehensive analysis of gender equality progress across all 17 Sustainable Development Goals (SDGs). Halfway to the end point of the 2030 Agenda for Sustainable Development, the world is failing to achieve gender equality, making it an increasingly distant goal. This report advocates for an integrated, holistic approach to advancing gender equality, involving multistakeholder collaboration and sustained financial backing. Neglecting to amplify efforts and invest in gender parity jeopardizes the entire 2030 Agenda for Sustainable Development.

Promising Practices for Gender Equality

UNDP – September 2023

This catalogue provides a directory of 37 promising policy measures that can support countries to better respond to future crises, and to build more gender-equitable societies and economies. These measures are the most promising practices distilled among the 5,000 policy measures adopted by governments in response to the pandemic and monitored by the UNDP-UN Women COVID-19 Global Gender Response Tracker.

Gender Lens Investing: Driving Financial Returns and Social Impact

Women’s World Banking – July 2023

Gender lens investing has emerged as a powerful impact investment strategy that combines pursuing financial returns with pursuing gender equality and social well-being. It recognizes the importance of investing in women as business owners, as purchasers/customers, as well as in their workforce and leadership roles, to foster stronger, faster-growing institutions that achieve better financial returns and create a more equitable world.

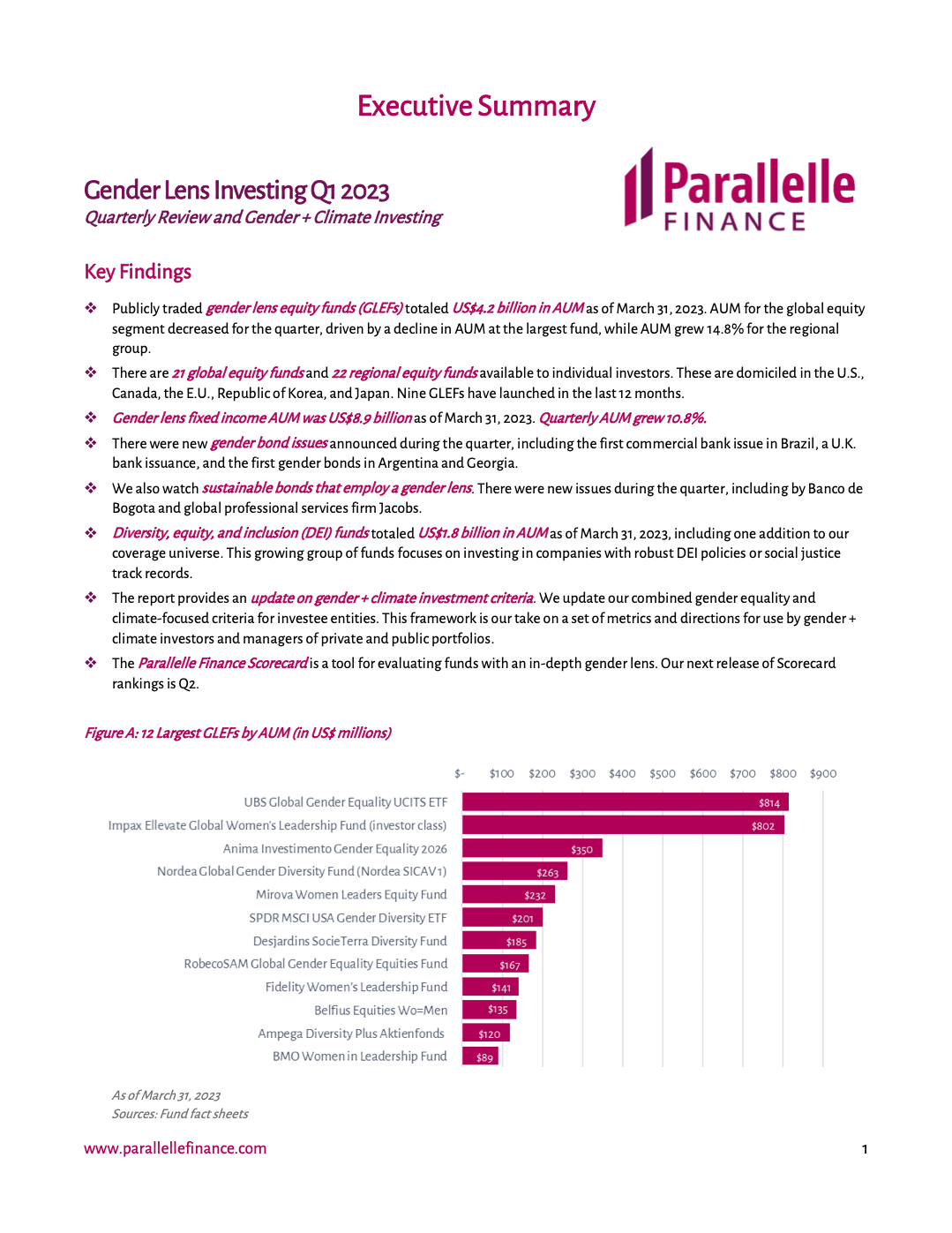

Gender Lens investing Q1 2023

Parallelle Finance – June 2023

Gender Lens investing Q1 2023 examines first-quarter performance and composition of gender lens equity funds and provides updates on gender lens fixed income, DEI equity funds, and women in the workplace and economy.

Reporting Gender Pay Gaps in OECD Countries: Guidance for Pay Transparency Implementation, Monitoring and Reform

OECD – June 2023

Pay transparency policies are gaining momentum throughout the OECD. Over half of OECD countries require private sector firms to report their gender pay gap statistics regularly to stakeholders like employees, employee representatives, the government, and/or the public. Gender pay gap reporting, equal pay audits and other pay transparency policies help advance gender equality at the workplace, as these measures present up-to-date information on a firm’s gender pay gap, encourage employers to offer equal pay for work of equal value, and give individual workers and their representatives valuable insights to fight for pay equity. This report presents the most thorough stocktaking to date of gender pay gap reporting policies and evaluations across OECD countries, and offers guidance to countries interested in introducing, reforming and monitoring their pay transparency systems to promote equal pay for women and men.

Joining Forces for Gender Equality: What is Holding us Back?

OECD – May 2023

OECD countries continue to face persistent gender inequalities in social and economic life. Young women often reach higher levels of education than young men, but remain under-represented in fields with the most lucrative careers. Women spend more time on unpaid work, face a strong motherhood penalty, encounter barriers to entrepreneurship and fare worse in labour markets overall.

Addressing the Gender pay gap in the Digital Economy

ILO/EPIC – March 2023

Hosted by the Equal Pay International Coalition (EPIC), this event will be an opportunity to amplify interest in innovative and practical solutions and in promising global initiatives to reduce the gender pay gap with attention to the digital economy. Special guests will engage in an interactive discussion to advance equal pay for work of equal value globally and take tailored action at the country level.

Experiences of violence and harassment at work: A global first survey

ILO – December 2022

The report is the first attempt to provide a global overview of people’s own experiences of violence and harassment at work, including its main different forms – be it physical, psychological or sexual – and respondents’ experiences with disclosing such occurrences.

Violence and harassment at work: a practical guide for employers

ILO – October 2022

The guide aims to enable enterprises to better control the risks and minimize the negative impacts that violence and harassment brings to the workplace. It includes, among others, guidance on what is considered violence and harassment in the world of work, examples of common violence and harassment at work, legal framework and employers’ responsibilities, why employers need to take action, how to address, prevent and respond to violence and harassment including by developing and implementing enterprise-level policy, as well as risk management with sharing of good practices and examples.

The gender pay gap in the health and care sector: A global analysis in the time of COVID-19

ILO – July 2022

The health and care sector is a major source of employment globally, in particular for women. The health and care workforce accounts for approximately 3.4% of total global employment, including approximately 10% of overall employment in high-income countries (HIC) and a little over 1% in low- and middle-income countries (LMIC). One feature that characterizes employment in this sector across the world is that it is a highly feminized sector – women make up about 67% of global employment in the sector – with a significant degree of gender segregation. However, the share of women among the workforce in the sector varies with the degree of economic development.

Inclusion of lesbian, gay, bisexual, transgender, intersex and queer (LGBTIQ+) persons in the world of work: A learning guide

ILO – May 2022

LGBTIQ+ persons face inequality, discrimination and violence and harassment on the basis of their sexual orientation, gender identity, gender expression and sex characteristics, everywhere, including in the world of work. They face discrimination in finding jobs and throughout the employment cycle. To contribute to the inclusion of LGBTIQ+ persons in the world of work the ILO has developed a learning guide aimed at representatives of governments, employers’ and workers’ organizations and other relevant stakeholders. The guide should help in the process of identifying and designing tailor-made local responses to ensure equal opportunities and treatment for LGBTIQ+ persons at work.

Gender Equality and the Empowerment of Women and Girls: Guidance for Development Partners

OECD – May 2022

Gender equality and the empowerment of women and girls are prerequisites to the realisation of the 2030 Agenda for Sustainable Development. This Guidance is a practical handbook for development partners supporting those global ambitions. Designed around the programme cycle and beyond, it provides practical steps for practitioners and examples of good practices, as well as checklists and recommendations on how to drive change.

Transforming enterprises through diversity and inclusion

ILO – April 2022

This report presents the findings from one of the most comprehensive studies on equality, diversity and inclusion conducted by the ILO during a period of immense disruption as the impact of the COVID-19 pandemic was felt worldwide. It contributes new understanding and insights to better support enterprises in creating powerful and comprehensive change in eliminating all forms of discrimination within the workplace and promoting equality, diversity and inclusion. It builds on the wealth of existing research showing the critical role of D&I in the high performance of the workforce, businesses, economies and societies globally.

How to Improve Indicators on Women’s Economic Empowerment: Guidance Note on Gender-Sensitive Survey Design and Implementation

World Bank – March 2022

This guidance note provides recommendations on how to operationalize methodological advances for indicators related to women’s economic empowerment in survey design and implementation, focusing on three key dimensions: asset ownership and control, work and employment, and entrepreneurship. It seeks to facilitate the transfer of internationally recommended best practices into country-level, household survey– specific advice. Applying the targeted recommendations presented here will allow countries to improve their ability to collect meaningful gender statistics that serve as a critical input to designing policies to improve economic opportunities for all.

Investment with a Gender Lens in Europe

UN Women – 2021

Investing in and with women leads to stronger economic growth, both more sustainable and inclusive. In Europe, regardless of the commitment from European institutions to promote gender equality, there is still a gender unequal representation of women in the financial environment. This report aims at creating a diagnostical mapping of investment and finance initiatives with a gender lens and/or positive impact on gender equality in Europe.

Gender Lens Investing Q3 2021 Review

Parallelle Finance · November 2021

- Gender lens equity funds AUM is US$ 3.56 billion in AUM (+35% year to date)

- Gender lens fixed income AUM is US$8.41 billion (+74% increase from December 31, 2020)

A snapshot of 350 companies in the G7

UN Women . October 2021

An enabling environment with strong multi-stakeholder interventions are key to achieving gender equality. This very notion is explored throughout this study, which offers insight on how the public and private sector interact to advance women’s economic empowerment in the world of work.

More specifically, this study: 1. Highlights G7 countries’ laws and policies impacting the lives of women; 2. Provides a snapshot of the status of WEPs implementation of the largest 350 companies in the G7; and 3. Illustrates that WEPs signatories generally perform better on gender equality than non-WEPs signatories.

2020 ESG Report

Japanese Government Pension Investment Fund (GPIF) · September 2021

The reports includes the entire supply chain in the greenhouse gas emissions analysis; expands the analysis to include not only traditional asset classes but also alternative asset classes such as gender equality; and provides an analysis of inter-industry transfer of opportunities and risks accompanying the transition to a low-carbon society.

Global Gender Gap Report 2021

World Economic Forum 2021

Another generation of women will have to wait for gender parity, according to the World Economic Forum’s Global Gender Gap Report 2021. As the impact of the COVID-19 pandemic continues to be felt, closing the global gender gap has increased by a generation from 99.5 years to 135.6 years.

Women and the Markets

S&P GLOBAL · October 2020

S&P Global, in partnership with AARP, examined Corporate America’s family leave policies to understand the relationship between family-friendly benefits and female representation in the workforce and senior management. The research is based on the results of a survey of 1,573 individuals who work for a firm with more than 1,000 employees and gender equality data from Equileap.

Gender Lens Investing in Public Markets: It’s More Than Women at the Top

Glenmede · October 2020

With a global public market size of $3.4 billion as of 2019, gender lens investing has moved beyond an examination of how many women are serving at the highest echelons of a company. The research used Equileap’s data on companies in the Russell 1000 (2014-2020) to identify the relationship between gender equity factors and performance. One conclusion is that, on a sector-neutral basis, companies in the top quintile of Equileap’s Category A (Gender Balance in Leadership and Workforce) experienced on average greater return and less risk than companies in the bottom quintile.

WomenCount2020

The Pipeline · July 2020

In the FTSE 100, there are more CEOs named Peter than female CEOs. In the FTSE 350, only 5% of CEOs, 16% of CFOs and 10% of executives are women.

Diversity wins: How inclusion matters

McKinsey · May 2020

Our latest report shows not only that the business case remains robust but also that the relationship between diversity on executive teams and the likelihood of financial outperformance has strengthened over time. These findings emerge from our largest data set so far, encompassing 15 countries and more than 1,000 large companies.

Gender Lens Investing: Assets Grow To More Than $3.4 Billion

Veris Wealth Partners · March 2020

According to a new analysis by Veris Wealth Partners, asset growth in GLI products accelerated and totaled $3.4 billion as of June 30, 2019. In our 2018 GLI analysis, we reported $2.4 billion invested in GLI products. As important, the size of the funds continued to grow, reflecting their growing popularity among individual and institutional investors. There were 10 investment products with over $100 million and six with over $250 million as of June 30, 2019.

Women on boards, 2019 Progress Report

MSCI · December 2019

The number of companies with majority female boards doubled in 2019 compared with 2018. Yet these 22 firms accounted for fewer than 1% of the constituents of the MSCI ACWI Index as of October 30, 2019; 98.7% of the boards remained male-dominated.

Are you missing millions? The commercial imperative for putting a gender lens on your business

PwC, in partnership with the 30% Club and WPP · November 2019

The report is produced by the 30% Club in conjunction with PwC, with support from WPP and case studies from global and FTSE100 diversity champions including Diageo, GSK, HSBC, Mastercard, PwC, Unilever and Vodafone. It aims to inspire and support businesses to seek commercial benefit by taking a more systematic and enterprise-wide approach to gender, far beyond the traditional focus within HR.

When Women Lead, Firms Win

S&P Global, by Daniel J. Sandberg · October 2019

The study finds that firms with female CFOs are more profitable and generated excess profits of $1.8T over the study horizon. It also found that firms with female CEOs and CFOs have produced superior stock price performance, compared to the market average. In the 24 months post-appointment,female CEOs saw a 20% increase in stock price momentum and female CFOs saw a 6% increase in profitability and 8% larger stock returns. These results are economically and statistically significant.

Sustainable Reality. Analyzing Risks and Returns of Sustainable Funds

Morgan Stanley · August 2019

Can you invest sustainably without sacrificing financial returns? Research conducted on the performance of nearly 11,000 mutual funds from 2004 to 2018 shows that there’s no financial trade-off in the returns of sustainable funds compared to traditional funds, and they demonstrate lower downside risk.

Investing in Gender Equality

PwC · June 2019

The report, prepared by PwC Norway and commissioned by Care and Storebrand, looks at the connection between gender diversity and corporate performance. The review of existing relevant literature finds that increasing female labour market participation can lead to many positive effects, such as increased economic growth, increased productivity and an increased economic resilience. It also finds that more diverse leadership can lead to increases in profitability.

Diversity from an Investor’s Perspective

New Financial, by Olivia Seddon-Daines and Yasmine Chinwala · May 2019

This report looks at why and how the most forward-looking asset owners (such as pension funds, insurers and sovereign wealth funds) are addressing diversity and inclusion. Their opinions count – as an essential source of capital for financial markets, the needs and actions of asset owners have a big impact on how the whole system operates.

Progress on the Gender Pay Gap: 2019

Glassdoor · April 2019

This study examines how gender pay gaps around the world have changed since Glassdoor’s initial study in 2016. Leveraging hundreds of thousands of salary reports, including detailed worker and job information shared voluntarily and anonymously by employees on Glassdoor, the gender pay gap in eight countries is estimated: the United States, the United Kingdom, Canada, Germany, France, the Netherlands, Singapore, and Australia. The gender pay gap persists around the world, but it is narrowing. In the United States, for example, the gender pay gap is estimated to close by 2070.

Research: Gender Pay Gaps Shrink When Companies Are Required to Disclose Them

Harvard Business Review, by Morten Bennedsen, Elena Simintzi, Margarita Tsoutsoura and Daniel Wolfenzon · January 2019

The study’s results suggest that disclosing disparities in gender pay does in fact narrow the gender wage gap. It also can increase the number of women being hired, indicating that the supply pool of female employees increases as gender pay transparency improves. It can increase the number of female employees being promoted from the bottom of the hierarchy to more senior positions. And it can lower companies’ overall wage bills, largely by slowing down the growth of male wages.

Just Good Investing: Why gender matters to your portfolio and what you can do about it

Calvert Impact Capital · December 2018

Whether we acknowledge it or not, gender is a major determinant of life outcomes around the world. On average, over 11 years, companies with higher percentage of Women in Leadership positions and Women in Board positions outperform companies with the lowest percentages. It’s not just the number of women that are important, it’s the ratio. Once a borrower exceeds 33% of Women in Leadership, we observe a more significant increase in financial performance.